The DeFi launchpad for DATs, SPACs, and ICOs — with zero offer costs, low management costs, and full transparency.

Chat with us on Telegram

Public stock buyers spent more than $20B on DATs and $20B on SPACs in 2025. Much of this capital was wasted due to high offer costs, high management fees, and lack of transparency.

Onchain offers improve the economics

Buyers pay no offering and structuring costs, and get redemption options

Minimal ongoing expenses, maximum value

Complete on-chain visibility and control

A new mechanism builds on the rapid growth of yield vaults. It supports new types of offers that fit between a redeemable yield vault and a closed ICO.

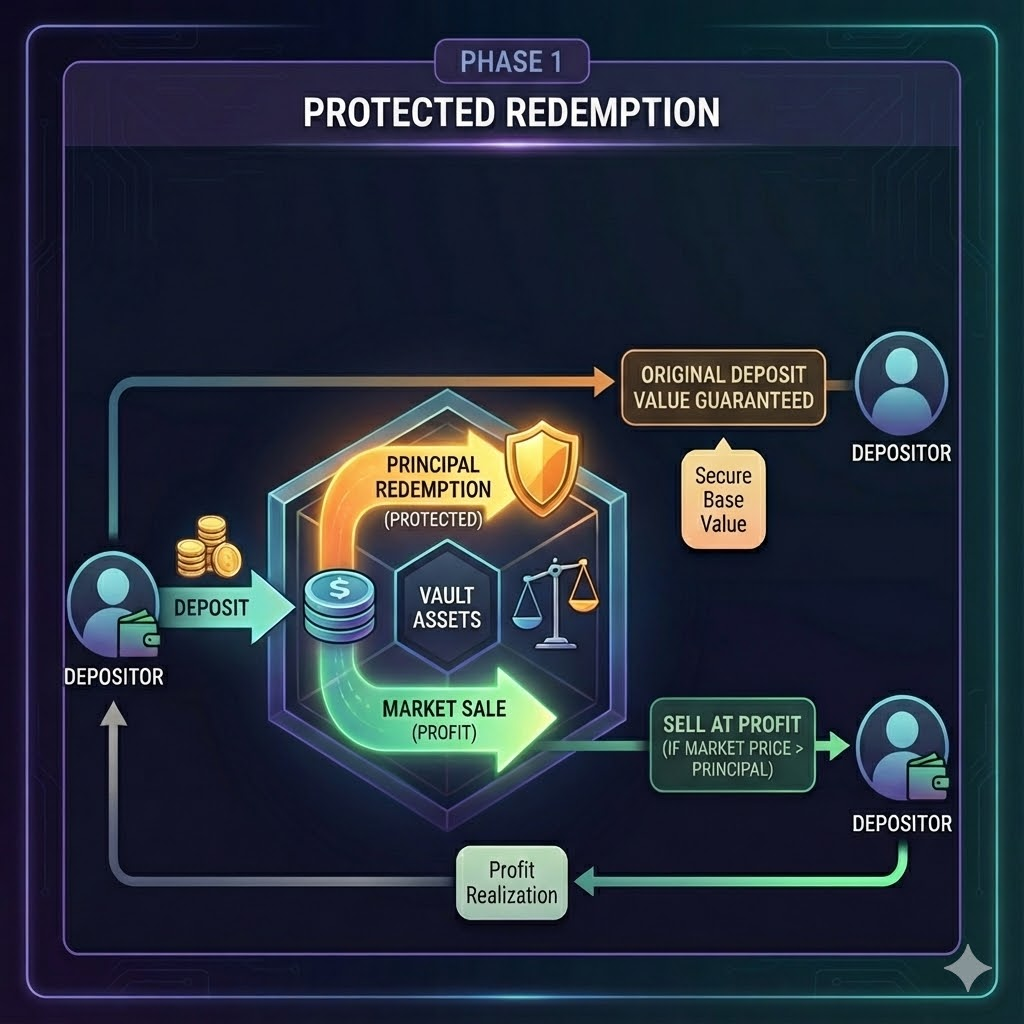

Depositors retain an option to redeem at the original deposit value

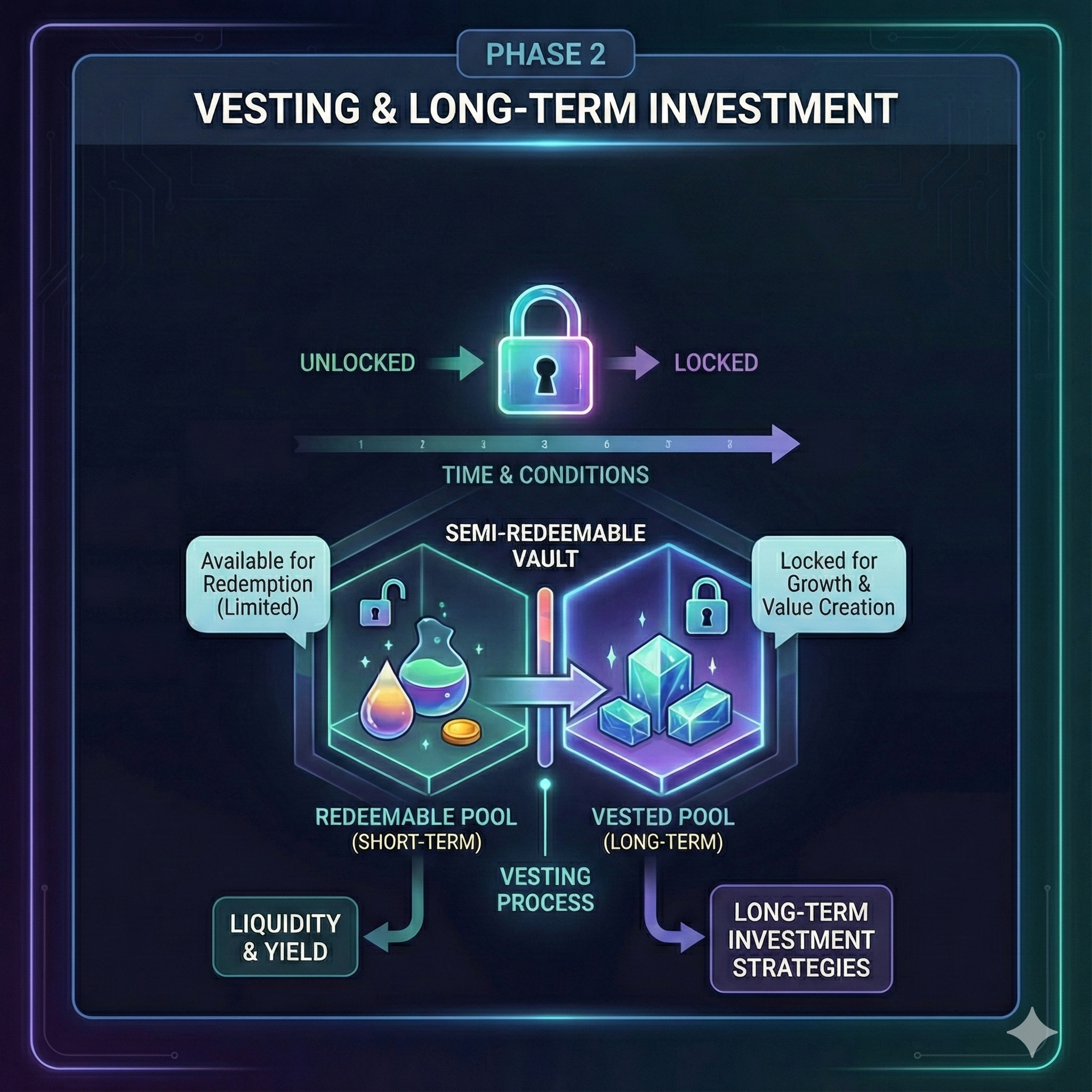

Redemption rights can expire over time, causing assets to "vest". Vested assets are locked for long-term investment, building value beyond simple yield.

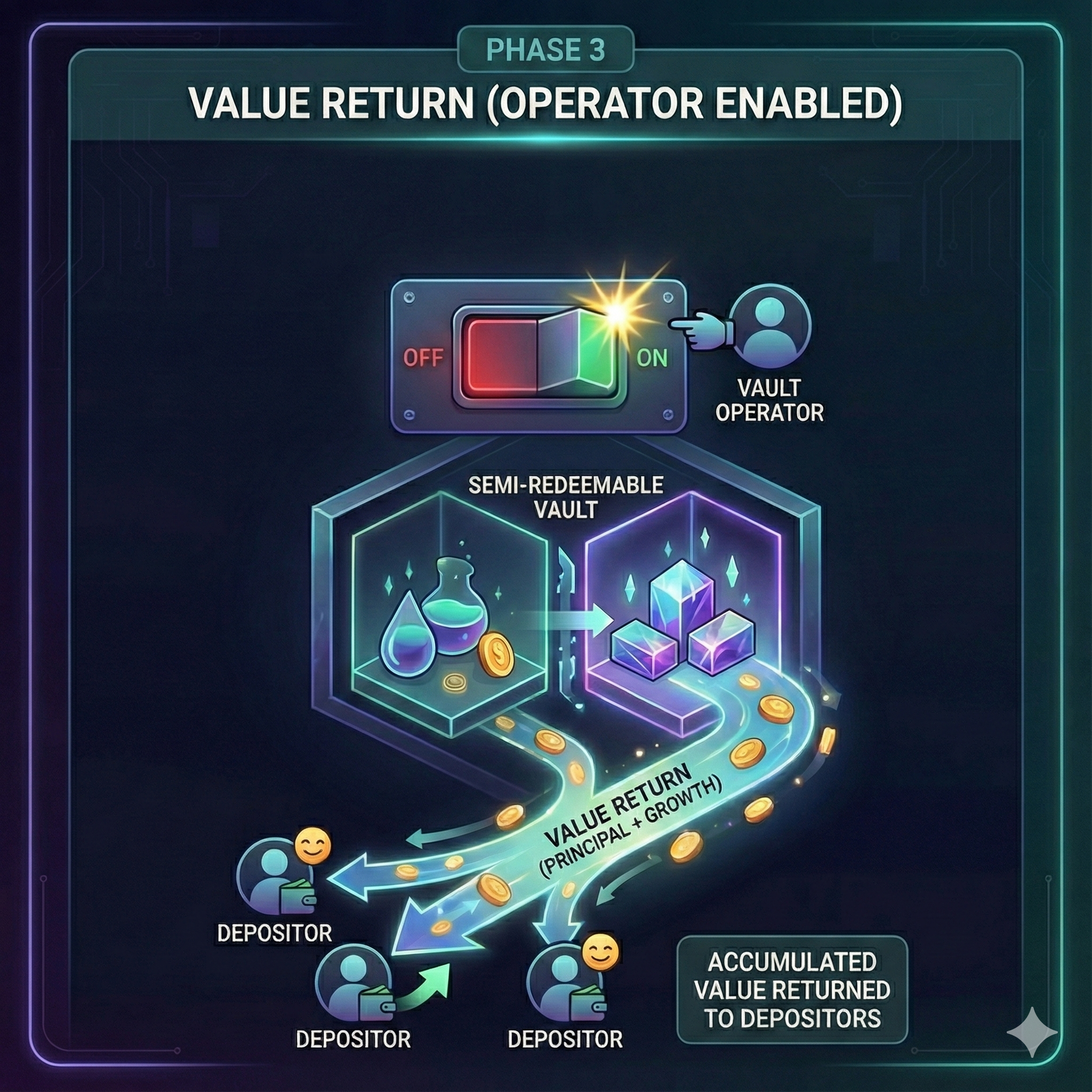

Vault operators can turn on redemption and easily return generated value to depositors.

Semi-redeemable vaults unlock new economics for DATs, ICOs, and SPACs.

A breakthrough in DAT economics giving buyers a chance to start at zero NAV premium with redemption options.

Issuers and managers of large cap assets with upside

Depositors get vault shares that increase with yield and can trade up to NAV premium. Redeemable at original deposit value unless sold or vested

Vested assets enable collateral for financing and long-term placements for better returns. Can eliminate NAV discounts by enabling redeemability

$20B in new DAT IPOs in 2025

Adds startup value, while protecting a redemption option.

Startups with significant channel and early stage product

Depositors buy vault token that's also a startup token/share. They lose redeemability if they sell or hold through vesting dates

Vested assets invested in startup growth. Token can trade as large-cap vault before adding significant project value, adding liquidity premium

$120B in convertible debt issuance in 2025

Dramatically improves SPAC economics by reducing offer costs and improving deal closing reliability.

SPV and SPAC sponsors wanting to deliver economic value to investors

IPO buyers get redemption rights. Lose redeemability if they sell or vest. At deal finalization, option to redeem with yield or convert to new deal

Vested assets and custom warrants increase predictability of cash delivery. Bonus warrants for IPO buyers who hold through closing

$25B in SPAC issuance in 2025

The team brings decades of experience in financial engineering, technology development, and community building.