Add upside to your favorite coin with an Easy DAT

DAT

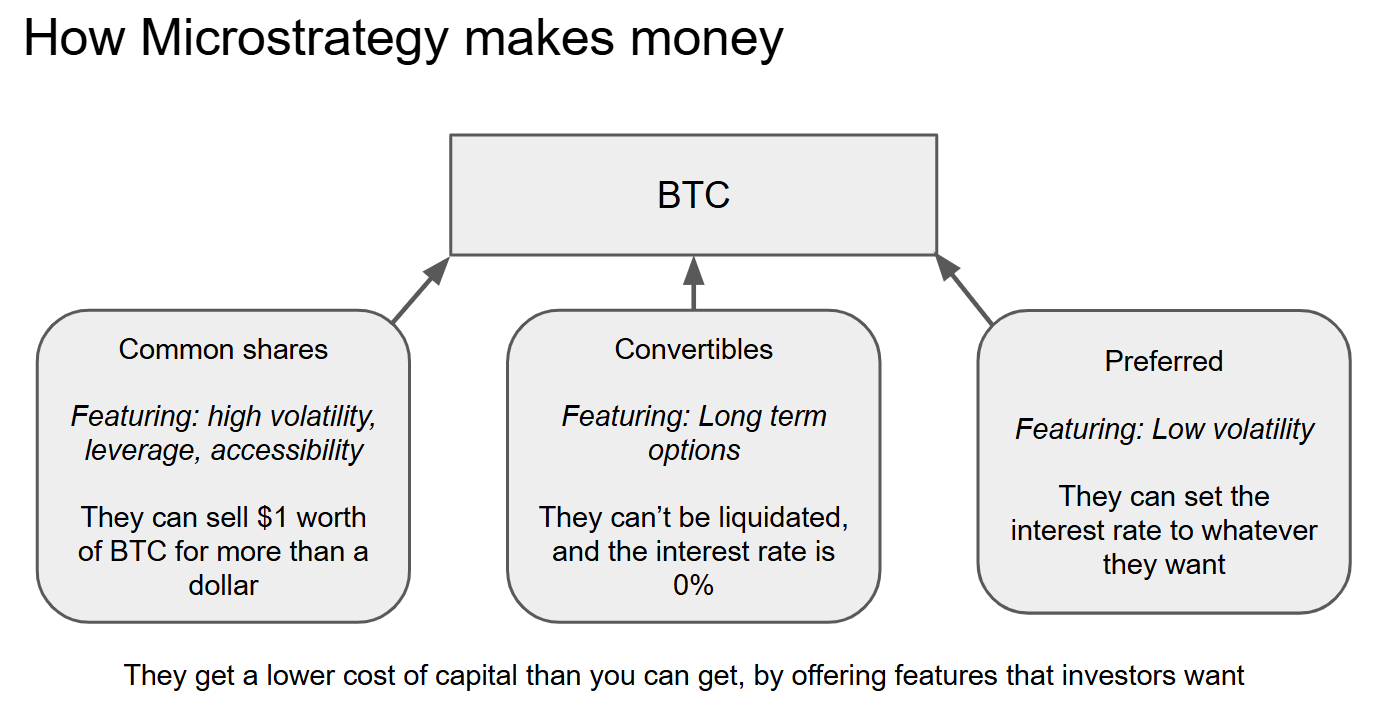

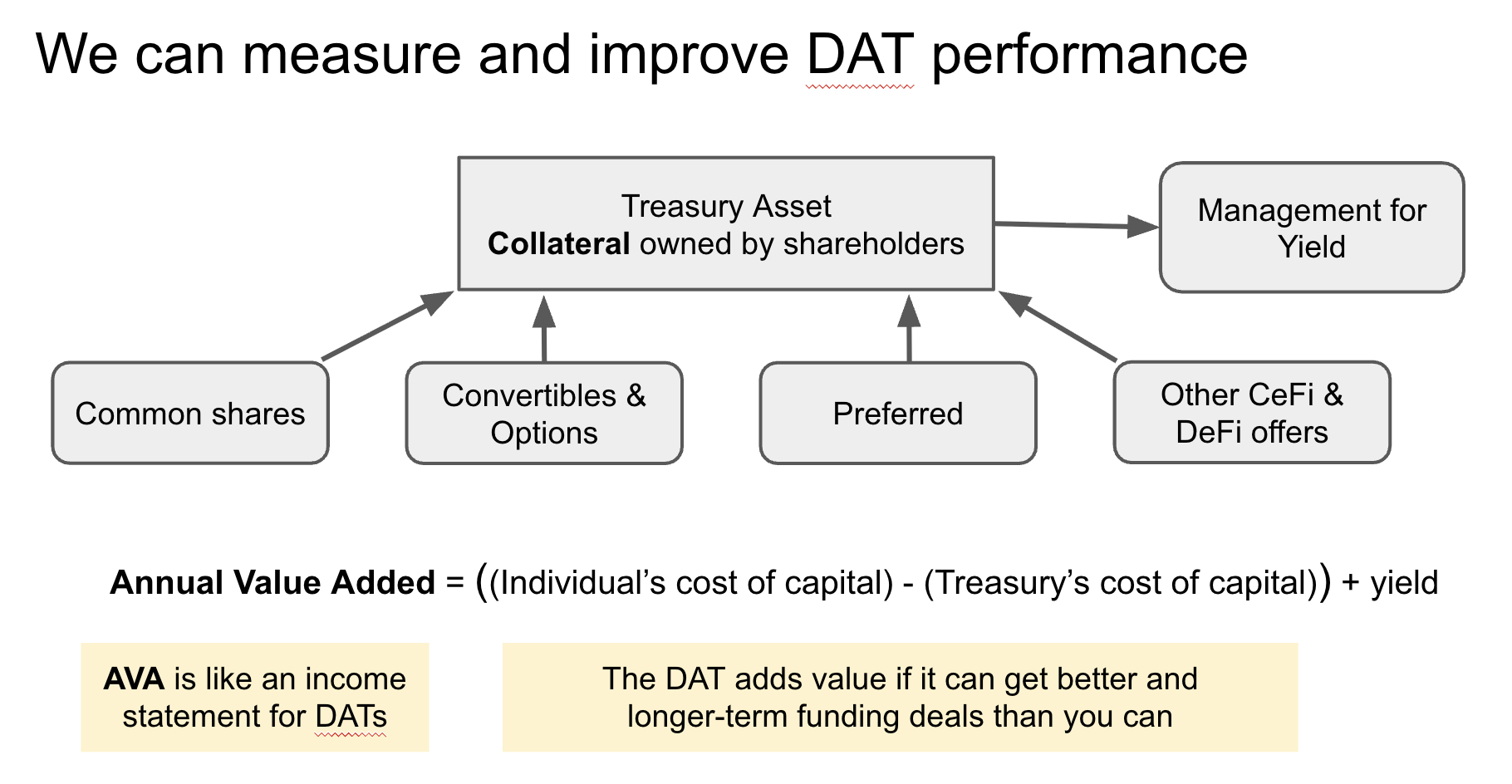

A Digital Asset Treasury locks up coins, and uses them as collateral for long-term financing. DATs can get financing on favorable terms, generating value that adds a NAV premium.

Yield Vault

A yield vault earns yield on your favorite coin, helping you to compound gains. You can redeem it for the underlying coins.

Easy DAT gives you BOTH options

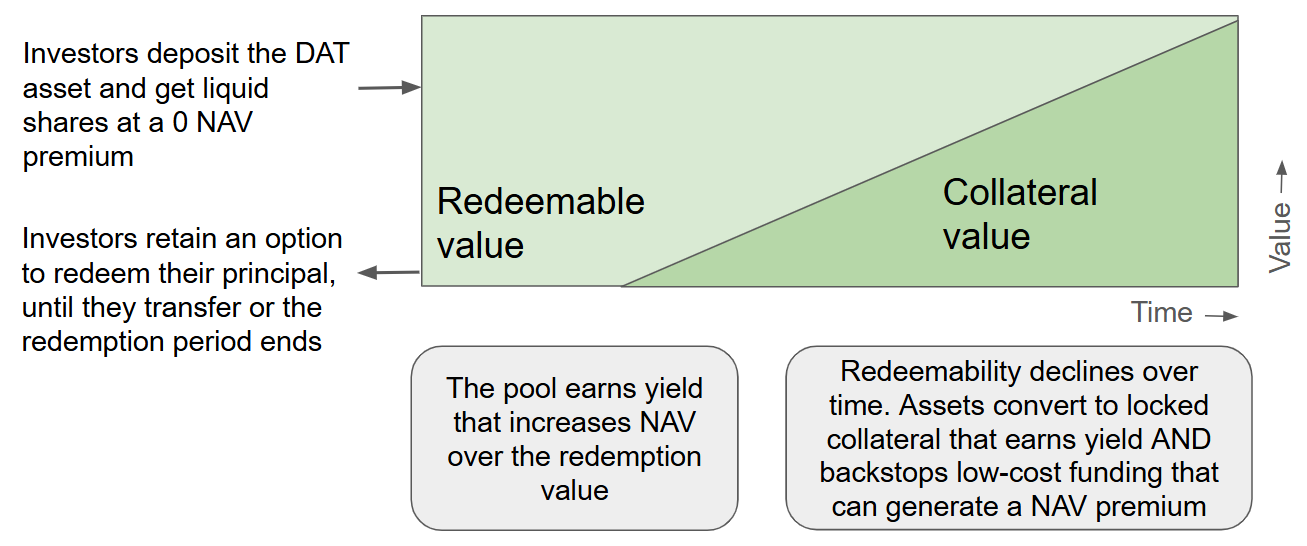

Upside: Buyers get liquid tokens that represent a share in a Treasury at 0 NAV premium. The NAV value of these shares will increase with yield. Shares can deliver additional returns by trading up to a NAV premium.

Redemption: Buyers can redeem and get their deposit principal back.

Buyers lose the redemption option if they transfer (often by selling at a profit) or hold beyond the redemption period. Early buyers get longer redemption periods.

How DATs add value

DAT buyers believe that over the long term, their asset will grow in value compared with fiat currencies like USD. The goal of a DAT is to accumulate an asset with leverage, and hold it through long-term price cycles.

Easy DAT uses an efficient on-chain structure

Cost

An on-chain structure avoids millions of dollars worth of setup costs that are required for a public stock company.

Low costs make it easy to return assets if the DAT stops adding value.

Liquidity

A publicly traded security under $300M in valuation is a "microcap" with limited visibility and liquidity. The crypto trading market provides liquidity for smaller cap issues, and opens up the opportunity to sell an expanding array of financing instruments.

Yield

On-chain deposits are ready for allocation to DeFi yield and tokenized instruments

Powered by yield for unstable coins

We can make new and improved DAT offers because we add yield.

Stak finds yield for DAT assets. These assets earn little yield from borrowers. Stak expands the supply of yield by analyzing multiple strategies and reaching them in multiple venues. It develops specialized skills around staking, trading, and USD borrowing.